Farming takes a number of up front costs, and one of those could be purchasing land. What do you do if you don’t have the cash? Whether you’re getting the land to start a farm or expand your farm, a land loan could be the answer.

How do Land Loans Work?

A land loan is a loan designed to help you purchase vacant land which can be used in different ways, such as farming or building a home. Land loans are generally harder to qualify for than a traditional mortgage. If you plan to build a home, it may be more difficult to get approved, and it could come with higher interest rates. However, you could refinance everything into a mortgage loan once the house is built, giving you better rates and helping you save long term.

If you’re purchasing land to start or expand a farm, there are a number of programs available that may be easier to get. Oftentimes, farmers or future farmers can qualify for up to 100% financing with lower interest rates through a local bank or credit union and government programs.

Types of Land Loans for Farms

When getting a land loan for farming, it's best to check with a bank or credit union close to the land itself. They’ll know the local ag market well and understand the needs of farmers in the area.

Here are all the ways you can get a land loan for your farm.

Agricultural Real Estate Loans

This type of loan covers the purchase of land for row crop farms, pasture land, smaller hobby farms, or even hunting rental property. Loan terms will depend on a number of factors including:

- How land will be used

- Experience in farming

- Current business or projections

- Personal Finances

- Current state of the land

The type of farming you plan on doing will decide the length of the loan and how often it can be renewed. For instance, a loan for a row crop farm might renew every 12 months, while a loan pasture land might have a 10 to 15 year term. Keep in mind that land loans will typically require a down payment¹, so having money up front may be needed.

You’ll also need to consider the type of land you want to purchase. If it's raw land (land that is completely undeveloped)², it may take more work to make it usable. If it’s improved land (land with full access to utilities and roads) it may not take as much work to prepare, especially if it’s currently being used for farming. Raw land loans may have higher rates than improved land loans because lenders view raw land as more risky - there’s more work required to use it. For this same reason, lenders tend to give lower interest rates on loans for developed land, which is usable right away and therefore considered less of a risk on the investment.³

At Southern Bank, we’re able to tailor each Agricultural Real Estate Loan to the needs of the farmer. No matter the situation, it’s worth it to see what options could be available to you. To get the conversation started, find a local Southern Bank lender here.

FSA Farm Ownership loan

The United States Department of Agriculture (USDA) offers programs through its Farm Service Agency (FSA), such as the Farm Ownership loan program, which helps farmers purchase farmland, expand current farms, and more. You can either visit your local FSA service office to get a loan directly through them or go through a local bank or credit union to get an FSA guarantee. If cash flow is tight and you still owe a lot on your assets, a loan guarantee from the FSA is a great option.

The amount of your FSA guarantee will depend on how long you’ve been farming and the type of farming you will be doing. For instance, a farmer with 10 or less years of experience could qualify for a 95% guarantee from the Farm Ownership loan guarantee program. If you’re in poultry, this guarantee might be good for around 15 years, while a row crop farm might get a guarantee for 5 years.

Southern Bank is a preferred lender with the USDA, meaning we can easily work with the FSA to get what you need. We’ll take care of the leg work, communicate with them, answer your questions, and help you get all the right paperwork filled out so you don’t have to go through the process alone.

Commercial Construction Loan

A commercial construction loan can be used for buying land that will be developed for commercial use. While this is less common, you could go this route if you’re planning to build a shop or non-residential building on the land. Construction loans act more like a line of credit initially⁴, providing funds for each phase of construction. The benefit here would be getting a single loan for the land purchase and construction of any non-residential buildings, rather than financing them separately.

SBA 504 loans

The Small Business Administration (SBA) offers the 504 loan program which helps small businesses purchase, construct, or improve assets like buildings or land.⁵ These loans aren’t often used for the purchase of farmland since most farmers will go through the USDA. However you could go this route if you are unable to get what you need elsewhere. You can learn more about SBA 504 loans here.

What you need to get started

When you’ve decided to go in for a loan, here are the things you’ll need to bring with you for our lenders to look over:

A Plan for the land - The first step a lender will take is to analyze your purpose for the land. You can improve your chances of approval by bringing a well organized plan that makes sense for the land. You’ll also want information about the land itself, such as a survey of the property⁶.

Tax returns - To verify that your finances are in order, our lenders will require the last 3 years of tax returns. Bring copies to help speed up the approval process. Most lenders will also look at other personal information such as your credit score.

Balance Sheet - If you’ve been in business, a balance sheet will be required to show how the business has been doing. If you are just getting started, then a lender will need to see business projections.

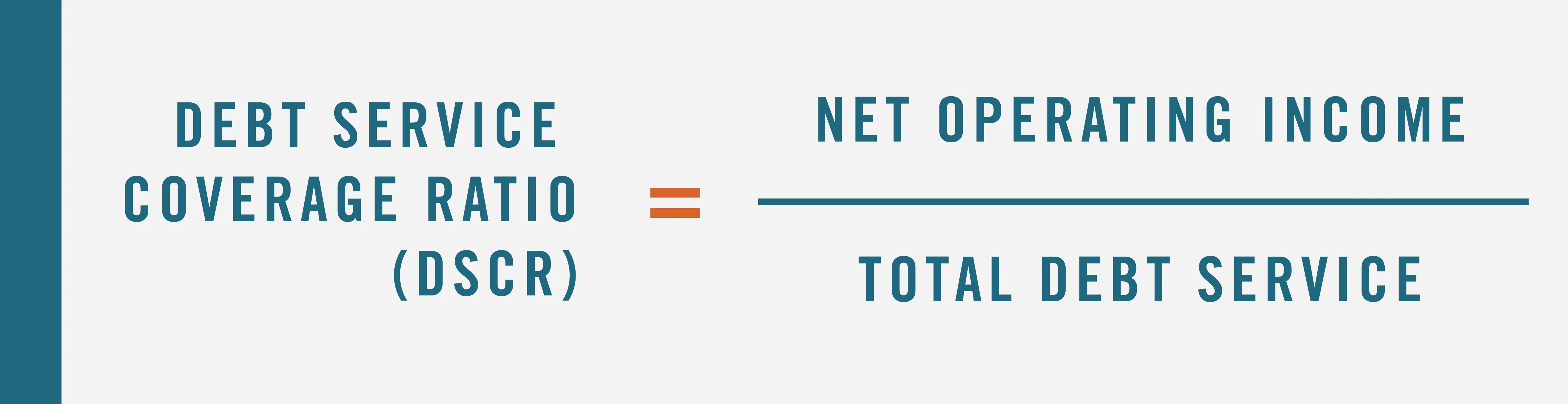

Income Statement - In order to assess your business’ ability to handle more debt, lenders will calculate your Debt Service Coverage Ratio (DSCR), which uses information found on your income statement. Here’s how it’s calculated:

The higher the ratio, the better a business will be at making debt payments. A DSCR of 1 is the break even point for covering debt. A number higher than 1 shows that the business is able to cover debt with operating income alone, while a number below 1 shows a net loss. Our ag lenders usually look for this number to be 1.2 or higher in order to approve a loan.

Get Started with Southern Bank

We know it’s not easy running a farm or getting one started, that’s why having a trusted financial partner can make a huge difference. Find the right financial partner for your farm by locating a Southern Bank Ag Lender near you to set up a meeting. They’ll take your information and work with you to get the loan your farm needs.

Disclosures & References:

1

Andrew Dunn, Rebecca McCracken, Land Loans: Everything a Buyer Needs to Know, lendingtree.com, Oct. 3, 2021,

https://www.lendingtree.com/home/mortgage/how-to-get-a-land-loan/

2

Sloan Hammer, How Do You Get a Land Loan? Rates and Procedure, Explained, valuepenguin.com, Jan 3, 2022,

https://www.valuepenguin.com/mortgages/how-do-you-get-a-land-loan

3

Emma Tomsich, Land Loans: Everything You Need To Know, rocketmortgage.com, Aug 2, 2022,

https://www.rocketmortgage.com/learn/land-loans

4

What Type of Loan Do I Need to Buy Land?, truliantfcu.org, Accessed Aug 1, 2022, https://

https://www.truliantfcu.org/borrow/land-loans/what-type-of-loan-do-i-need-to-buy-land

5

Zach Wichter, What Property Buyers Should Know About Land Loans, bankrate.com, Jun 2, 2022,

https://www.bankrate.com/mortgages/what-property-buyers-should-know-about-land-loans/

6

Matt Danielsson, Land Loans: 3 Things to Know Before You Buy Land, investopedia.com, Jun 29, 2022,

https://www.investopedia.com/articles/credit-loans-mortgages/090716/land-loans-3-things-know-you-buy-land.asp