As people prepare for the holidays, many companies see an increase in business both online and in-store. This increase in business also comes with an elevated risk of scams targeting businesses.

In today's digital age, the threat of scams looms large, posing serious risks to the financial health and reputation of companies. Recognizing the red flags, understanding the types of scams that exist, and implementing preventive measures are essential for safeguarding your business.

Red Flags of Business Scams

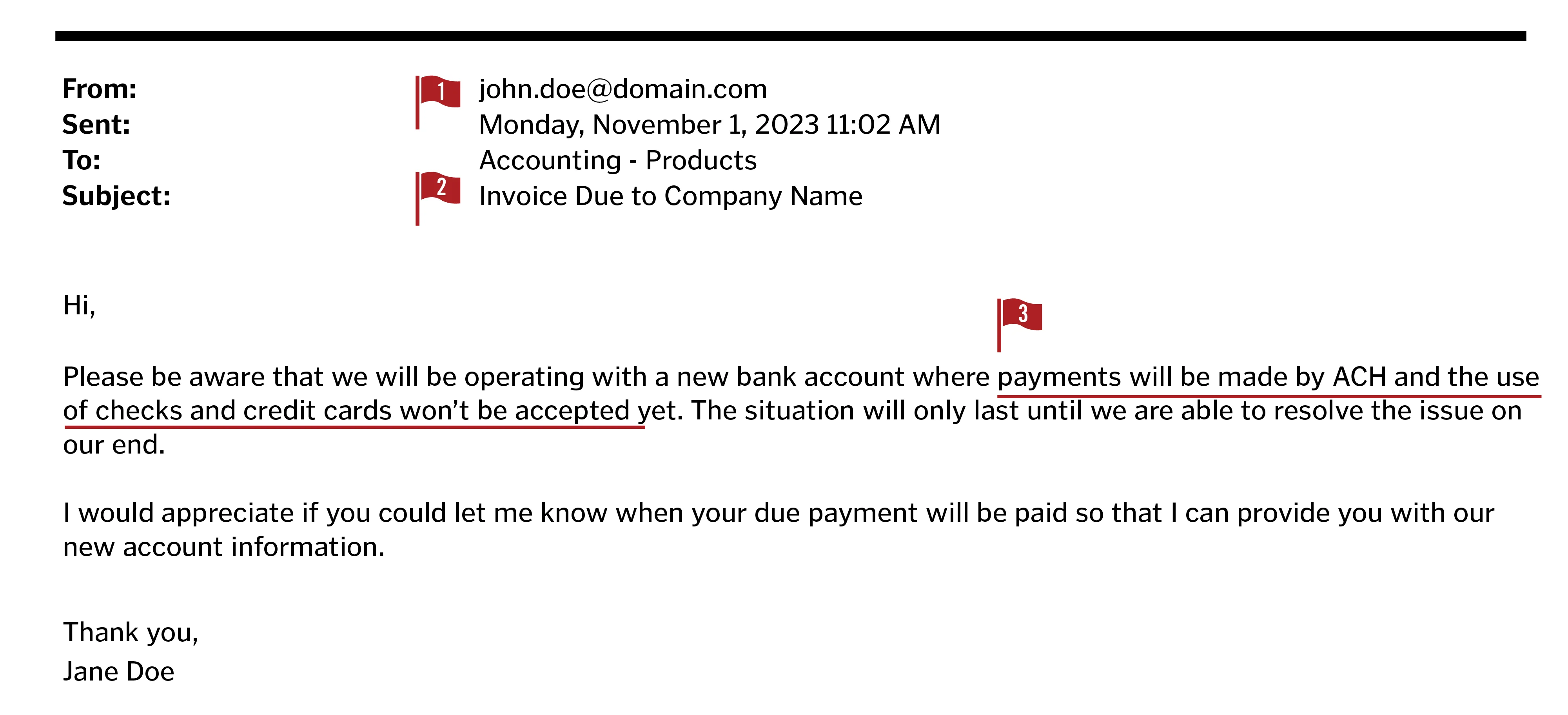

Take a look at this email and see if you would recognize the red flags within it:

- Unusual Communication from a trusted vendor - Does the email address look familiar? Whether it's a familiar client, vendor, or colleague, scammers use social engineering to gain trust and access sensitive information. If you’ve received communication that seems unusual, trust your gut, even if it seems to be from a familiar source. Take a step back and reach out to the source directly through a trusted avenue, like the number on their website, to verify it’s really them.

- Creating a sense of urgency, intimidation, and fear – This email makes it seem like you have an invoice that’s due, creating a sense of urgency to pay it soon. Scammers might even threaten legal action or claim an imminent financial crisis to pressure businesses into making rushed decisions. The less you think about your decision, the easier it is for them to steal from you. Take your time, and never give in to the pressure to make quick decisions.

- Requesting payments in specific ways – Notice that the email is requesting payment specifically through ACH and they tell you to reach out for the account information. Businesses spend a lot of time paying various vendors. Scammers take advantage of this by inquiring about payments or changing payment methods you’re familiar with. While they could request a wire transfer or cryptocurrency, they may claim a new bank account and request payments be made only to a new routing and account number by ACH like in this email. If a vendor is requesting payment through a new method or to a new account, always verify this with them directly through familiar channel.

While not every scam is the same, most will exhibit these red flags, and as you can tell, they can be very subtle. Emails like this one could result in huge losses for your businesses if you’re not careful. Scammers often employ deceptive tactics to manipulate unsuspecting companies, and your best bet is to be aware of these common red flags.

Types of Business Scams

The landscape of business scams is always evolving. Various schemes target different aspects of a company's operations, seeking to exploit weaknesses for financial gain. Some prevalent examples include:

- Business Email Compromise (BEC) Scams, in which attackers compromise email accounts to impersonate executives, then manipulate employees into transferring funds.

- Fake invoices and unordered merchandise scams involve sending fraudulent invoices or unsolicited goods, relying on the recipient's lack of scrutiny.

- Online listing and advertising scams deceive businesses into paying for fake advertisements or listings, promising increased visibility and customer traffic.

- Government impersonation scams often involve fraudulent communication from entities claiming to be government agencies, coercing businesses into paying false fees or fines.

- Business directory scams entice companies to pay for inclusion in a non-existent or worthless directory.

- Social engineering, phishing, and ransomware attacks rely on human error to gain unauthorized access or extract sensitive information.

- Investment scams lure businesses into investment schemes, promising unrealistic returns.

- Credit card processing and equipment leasing scams involve the use of payment processing equipment to steal funds through hidden transaction fees, leasing scams, and more.

- Overpayment scams trick businesses into refunding excess amounts, only to find that the initial payment was fraudulent.

Protecting Your Business from Scams

Safeguarding your business from scams requires a multi-faceted approach. Here are some tips:

- Maintain good records - This is crucial for tracking transactions and identifying discrepancies promptly. If something were to happen, having a paper trail could also help authorities locate the scammer and recover funds.

- Regularly train your staff to recognize and respond to potential scams – You might have a grasp on identifying the red flags of scams, but do your employees? It only takes one employee clicking on the wrong link in an email to compromise an entire business. Setting up a program to train employees and emphasizing the importance of skepticism is crucial in protecting your business.

- Verify invoices and payments – Scammers will try to convince you that a new method of payment is required using fake invoices from businesses you work with. Make sure anyone making payments within your business knows to reach out and verify invoices and forms of payment before sending money.

- Protect your devices – Maintain up-to-date security measures like VPN’s, strong email filters, and anti-virus software on all business devices to mitigate the risk of unauthorized access and lower the risk if an employee clicks on a bad link.

How to Respond When Your Business Has Been Scammed

If your business falls victim to a scam, a swift and strategic response is crucial to minimize damage. Act right away and follow these steps:

- Contact your financial institution right away: Notify your bank and any other financial institutions involved in the transaction. They may be able to freeze or reverse the transaction if reported promptly.

- File a report with local authorities: Report the scam to your local law enforcement agency. Providing details about the incident can aid in ongoing investigations and potentially prevent similar scams.

- Inform the FTC and other agencies: Report the scam to the Federal Trade Commission (FTC) and any other relevant regulatory agencies. This helps create a comprehensive database of scams, aiding authorities in their efforts to combat fraudulent activities.

- Alert your state Attorney General: Reach out to your state Attorney General's office. They can provide guidance on further actions you may need to take and work to stop further damage to other businesses. For more information visit NAAG.org.

Business scams pose a significant threat to the stability and success of companies across industries. Recognizing the red flags, understanding the diverse array of scams, and implementing preventive measures are crucial steps in safeguarding your business. By staying vigilant and training your staff you can fortify your business against the threat of fraudulent activities . Remember, protecting your business is not only about securing financial assets but also preserving your reputation and maintaining the trust of your clients and partners.